Accounts Module (Administrator guide)

Contents

- 1 What is the Accounts Module?

- 2 Setup of the Accounts module

- 3 Overview of the Accounts module

- 4 Assigning accounts codes

- 5 Accounting for Clubs & Clinics/Individual Budgets

- 5.1 Cost Centres for Clubs & Clinics

- 5.2 General Charge Rates

- 5.3 General Rates in Projects

- 5.4 Assign rates to activity

- 5.5 Carry out activity in Charitylog

- 5.6 General pre-invoice lists

- 5.7 Checking invoice details using "View Invoices" and "List Invoices"

- 5.8 Printing invoices

- 5.9 Exporting invoice data to Sage/Access Accounts

- 6 Accounting for Support Worker activity

- 7 Accounting for Handyperson activity

What is the Accounts Module?

If you're using the Handyperson Module, you will probably be using the simple accounting tools that it provides - namely, charging for materials and work done, automatically working this out to give a cash total on the job card, and producing reports about how much money has been spent/charged.

We soon found that some of our clients needed more accounting functionality. More and more organisations are having to account for exactly what they have done, and provide an invoice to (for example) the council, rather than just working under an SLA. Individual Budgets are also having an impact (where the client is given benefits/grants and has to purchase and manage their own care/services, rather than the care/services being provided to them with no money changing hands). The Accounts Module is the answer.

Using the Accounts Module you can:

- Automatically generate invoices for club/clinic activity (when using the Clubs and Clinics module), support work (when using the Support Worker Module), and handyperson services (using the Handyperson module).

- Create invoices to the client directly, or invoice a funder/organisation on their behalf.

- Print invoices directly from Charitylog.

- Export invoices directly from Charitylog to the industry-standard Sage Line 50 accounting package, with department and nominal codes automatically assigned.

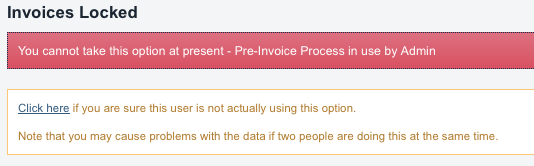

Accounts module warning

It is important that invoices are not created by two different system users at the same time. This would lead to errors in invoice numbering. Therefore, you may see a warning when you try and access accounting features, to make sure that the invoicing process is not in use elsewhere. If you know you are the only person using invoicing at that time, you can ignore the warning and continue.

Setup of the Accounts module

Before starting to use the accounts module, there are a few things that need setting up.

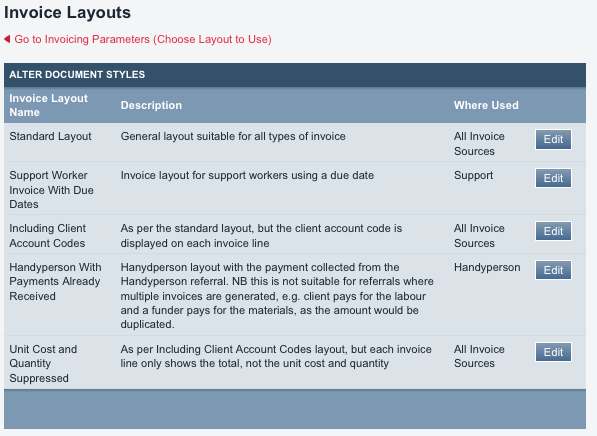

Invoice Layouts

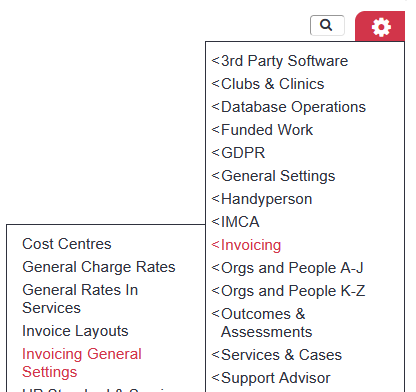

Click the "Invoice Layouts" menu item, in the "General Accounts Setup" submenu.

This will take you to a screen displaying the invoice layouts available. Currently Charitylog ships with five standard layouts, but there is scope to add to these - please get in touch if you need a different layout.

You do have some editing control, though - click the "Edit" button to edit a layout. Here the standard layout is shown.

You can set standard text, and a block of text to print on a following page to each invoice (this is useful for involved terms and conditions, for example). You can also specify image files (an absolute Web path) to print on your invoices. This is a good way to get your standard letterhead or graphics on your invoices.

Invoicing Parameters

Click the "Invoicing Parameters" menu item, in the "General Accounts Setup" submenu.

This screen will let you edit;

- Last used invoice numbers - very useful for starting your invoicing with Charitylog where a previous system stopped, rather than having to begin from 0.

- Which standard layout to use for each type of activity.

- Number of days until payment is due.

Payment Methods

Click the "Payment Methods" menu item, in the "General Accounts Setup" submenu.

Here you can set up custom payment methods, which can be used for particular customers (for example, if you have a few customers that pay cash, and the rest pay by cheque). This is only necessary if you want different text to be carried onto the invoice for a particular method - for example, you might want "Please only pay cash into our account at the bank directly. Please do not bring cash into our office" or similar for a cash payment method.

If you don't need different payment methods, you can ignore this.

Overview of the Accounts module

The accounts module is fairly separate to the rest of the system, which from the point of view of setup is a good thing, because end users don't usually have to worry about it. Usually, beside any activity which can be invoiced for, there will be a button which looks like a pile of coins. Clicking on this will let you see which charge rate is being used for the activity. In some cases there is a drop-down list of the available rates. There is a lot of setup to be done for the accounts module to work correctly, but once this is done, there is minimal ongoing work, apart from printing the invoices and exporting the data.

Occasionally you may see an error message like the following:

Accounts is one area of Charitylog where it is very important that there is only one person creating invoices at a time. Therefore the system is quite careful about letting more than one person use it, and will show this warning when it thinks there is a clash of users. If the warning relates to your own username, feel free to click "Click here" (as long as you aren't using invoice processing in several tabs at once, which is not advised). If the warning relates to another user, you should stop and contact that user to make sure that only one of you is using the invoicing section at once.

The accounts module is intended to be used to invoice for work once it has actually been carried out, but with some careful thought, it can also be used to invoice for work in advance. Working out the best way to do this can be tricky and so you should discuss this with your assigned Charitylog trainer, and with the support department.

The accounts module can currently be applied to Club & Clinic activity, Support Worker work, or Handyperson activity. Clubs & Clinics is part of the Charitylog core; Support Worker and Handyperson are two of the available add-on modules for Charitylog. You should have good grasp of what these modules can do before setting up the accounts module to work with them. If you need to invoice for other activity, such as volunteer assignments, please give the support department a call. We plan to extend the accounts module at some point, and we depend on customer feedback to let us know what we need to develop.

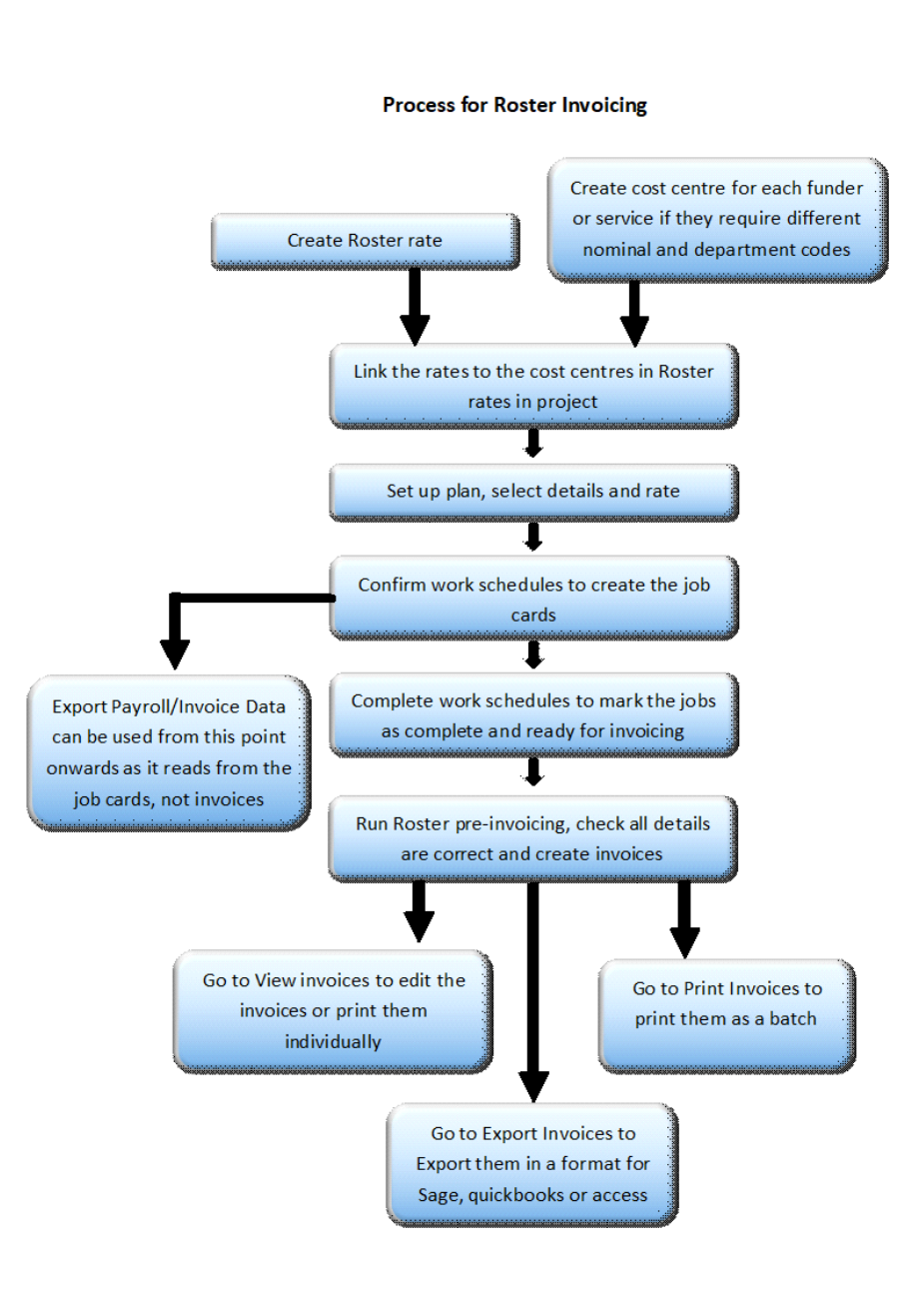

This flow chart shows the complete process, which we will use as the basis for this chapter.

Example set of nominal/department codes

As you set up the accounts module, you will need to enter department and nominal codes, which are a way of categorising activity and associated money. We will use the following set of example codes, and refer back to them throughout the guide.

Department codes

Daycare (private clients): 10 Daycare (council clients): 20

Nominal codes

General/other: 1000 Fixed charges and administration costs: 5000 Travel time: 7000 Mileage: 6000 Client mileage: 8000

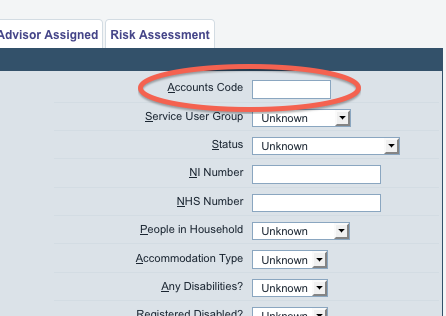

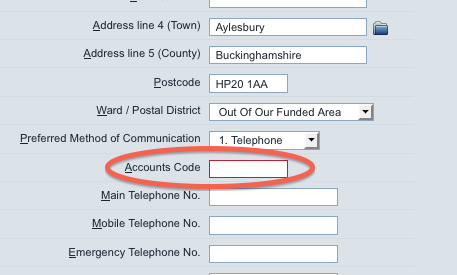

Assigning accounts codes

The first thing you will need to do as part of the setup of the Accounts module is to assign customer IDs to anybody who is going to receive an invoice. You may already have an internal system for accounts codes, or they may be provided for you by a funding body.

On the client details screen, there is a space for "Accounts code" on the Personal Details tab:

For funders, there is a similar field on the "General Details" tab of the Funder Details screen.

It is in a similar place on the Organisation Details screen.

Automatic accounts codes for people on your Charitylog system

If you do not have a preset system for assigning accounts codes, Charitylog will let you use People/Organisation IDs as your accounts codes, with a prefix if you want to apply one. This can be done in Operational Rules. Note that if you want to do this, the codes will not all be filled in automatically; you need to go to each client and re-save their record, and the "accounts code" field will auto-populate.

Accounting for Clubs & Clinics/Individual Budgets

Cost Centres for Clubs & Clinics

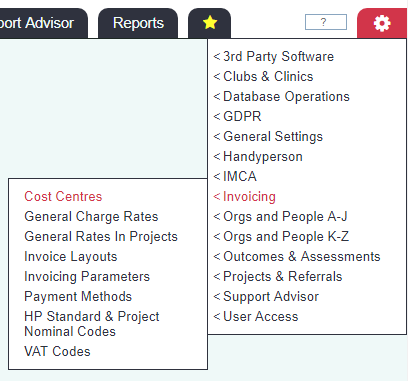

The Accounts menu (in standard form) has four submenus;

- Invoicing (containing the menu items for creating, printing and exporting your invoices)

- Support Accounts Setup (for setting up Support Worker-related accounting)

- HP Accounts Setup (for setting up Handyperson-related accounting)

- General Accounts Setup (for setting up general, i.e. Clubs And Clinics, accounting)

The menu item for Club and Clinic cost centres is in the "General Accounts Setup" submenu.

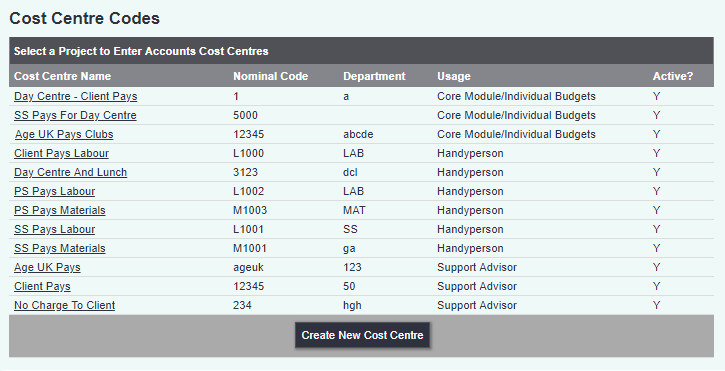

Clicking this menu item will take you to a screen where you can see the cost centres currently set up on your system, and enter new ones.

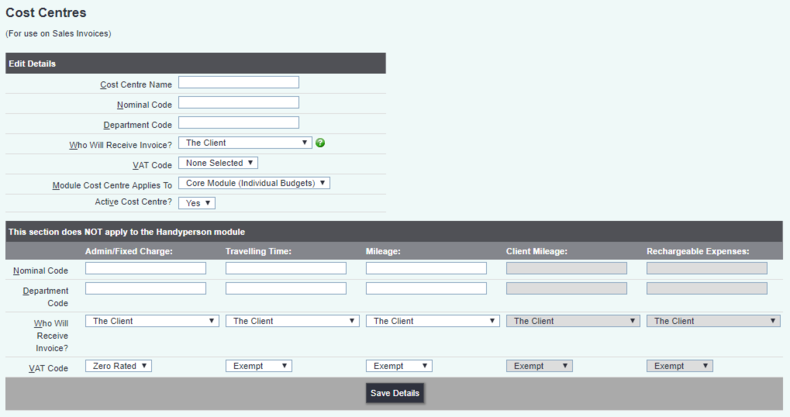

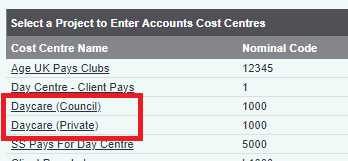

Click "Create New Cost Centre" and you will be taken to the following screen.

These screens, within the "Cost Centres" menu item, apply to all accounts activity.

The main purpose of the cost centre is to say who will pay for what, and to assign nominal and department codes to the activity. When specifying who pays, you will see a drop-down list of the people who have accounts codes set up on your system. When specifying the department and nominal codes, your finance officer will be able to advise you on what to use. Click here to see the example set.

If you're simply using Charitylog to create your invoices, but not exporting to another accounts system, you may simply want to use placeholders like "dep" and "nom". You do need to enter something; the system will not create invoices with missing codes, unless you specifically tell it to do so.

To set up the codes, it makes sense to do so with a scenario in mind, so here is our example scenario.

Our organisation runs daycare centres, and uses Charitylog's Clubs and Clinics module to manage attendance at them. Attendance at the centres is chargeable, but at two different rates. Private clients (that pay for themselves) pay £20 per day. Council clients pay £25 per day.

So there are two different people receiving invoices, and therefore you are going to need two Cost Centres. (It may turn out later that more are needed, to deal with other things, but a minimum of two will be required if we have two sets of people being invoiced.)

We will also need two charge rates, as there are two different amounts to be paid for the same activity.

An example cost centre might look like this:

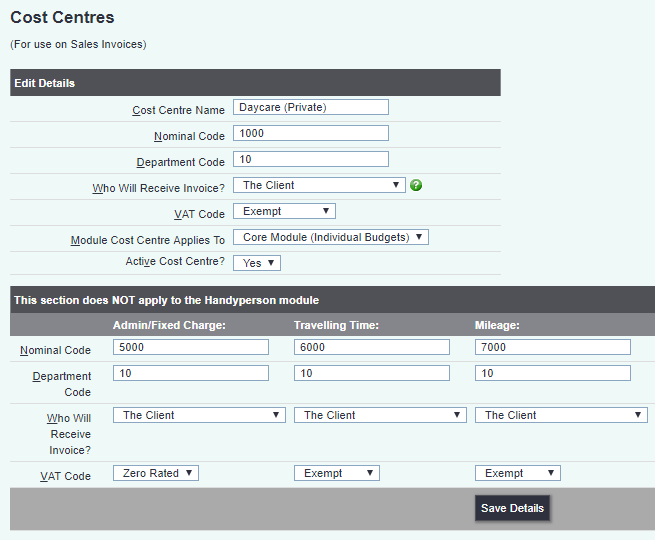

The council one will be set up in a similar fashion, but using nominal code 20 for everything. Once these are set up you will have two new cost centres on your system ready for use, as shown. You can now move on to setting up charge rates.

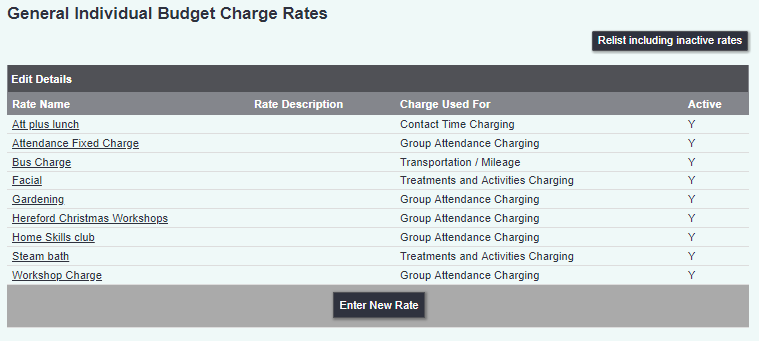

General Charge Rates

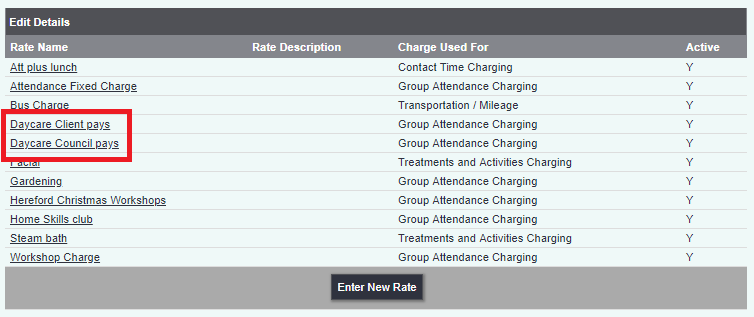

Click on "General Charge Rates" in the General Accounts Setup submenu, which will take you to the following screen:

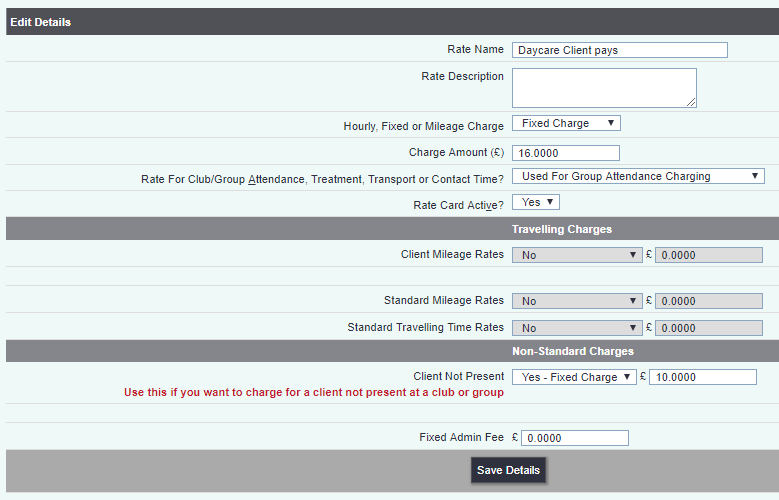

As you can see, there are two rates already set up, but we are going to use new ones. The charge rate for private clients might look like this:

- The client will be charged £20 for each attendance.

- Mileage (if there is any) will be charged at 45p/mile.

- If the client cancels they will be charged £10.

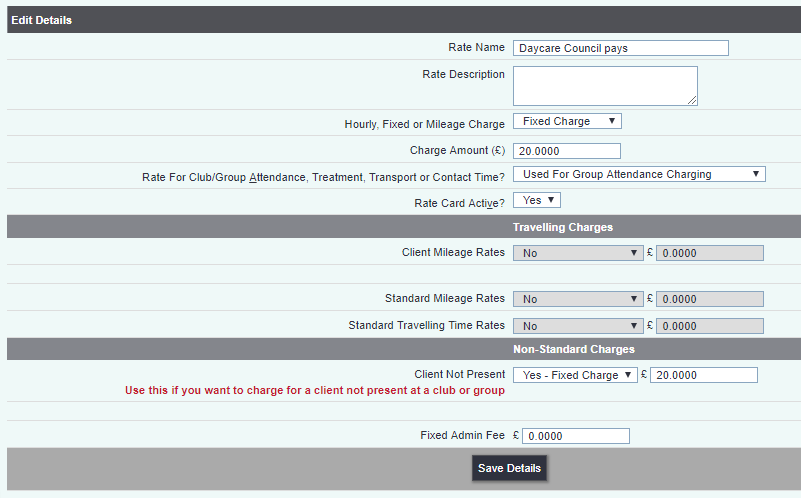

The rate card for council clients is to be set up the same way, but with a charge of £25, and for council clients, they will be charged the full fee even if they do not attend.

You should now have two new rate cards on your system.

Now you need to link the cost centres and rate cards to one another in the relevant project.

General Rates in Projects

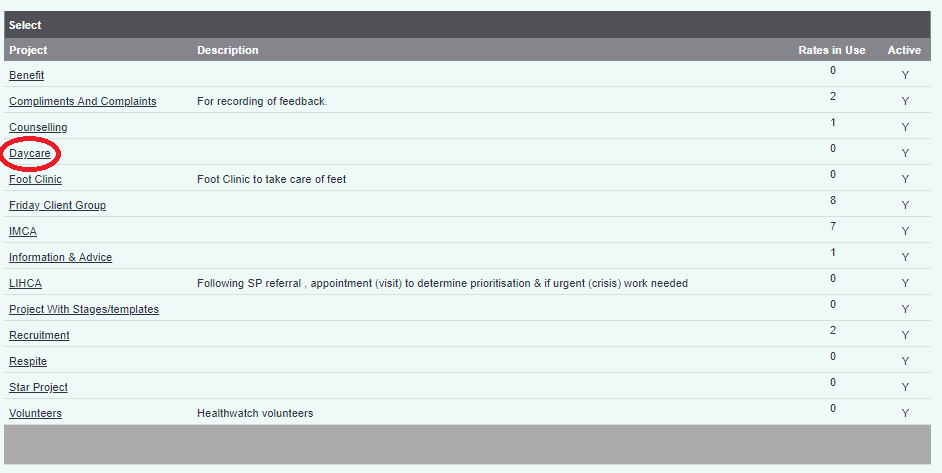

Click on the "General Rates in Projects" menu link.

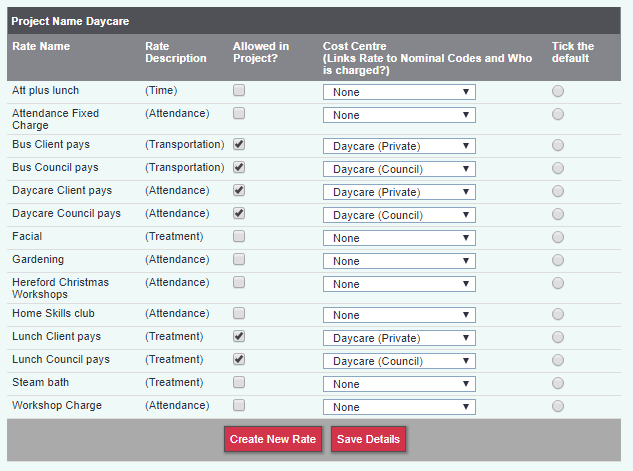

You now need to select the project in question (Daycare);

Then allow the charge rates in the project, and link them to the relevant cost centres.

Assign rates to activity

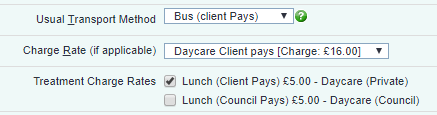

Whenever there is work to be invoiced, you need to set a charge rate for that activity. In the case of Clubs and Clinics, this rate is set on the membership card - which shows all details of the client's membership of that particular club or clinic. It can be accessed by clicking on the "Club & Clinic Membership" link at the bottom of any Client Details screen, and then clicking on the card as shown;

This will take you to the following screen. This shows all the details of this client's membership of this club, and there is a space for charge rate.

Once the rate is set, click "Save Details".

Carry out activity in Charitylog

The activity can now be carried out in Charitylog in the usual way. In the case of Clubs & Clinics, it can be done using the Wizard or by following the steps of the "Create/confirm/complete" process. Details of running Clubs and Clinics can be found here: Clubs and Clinics User Guide.

For the purposes of this guide, we have assigned four clients to the membership of our Daycare club; two private clients and two council clients.

Each time the club is run, the invoice creation process will start automatically.

General pre-invoice lists

Once the club has been run, you should be able to check the pre-invoice list to see that the invoices will create properly. If there are any missing codes related to the activity, you will be informed of this.

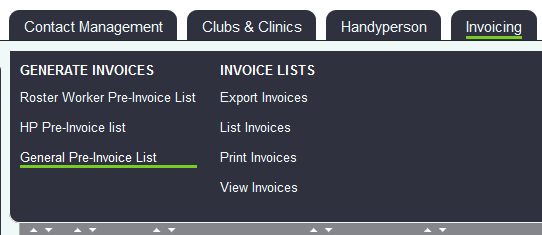

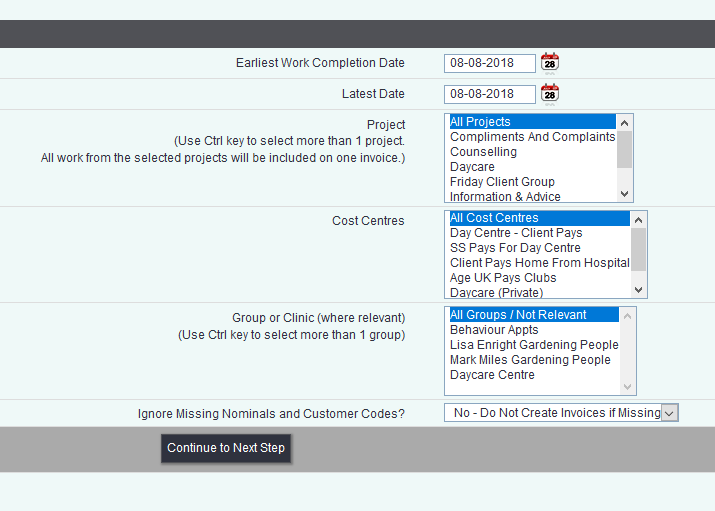

Click on "General Pre-invoice List" in the "Invoices" submenu.

You can now specify a date range, project and particular club. The pre-invoice list forms the basis of the invoices actually being created, so unless you know that you need to create invoices from all of the results, it's best to specify which clubs you want to check invoices for and when.

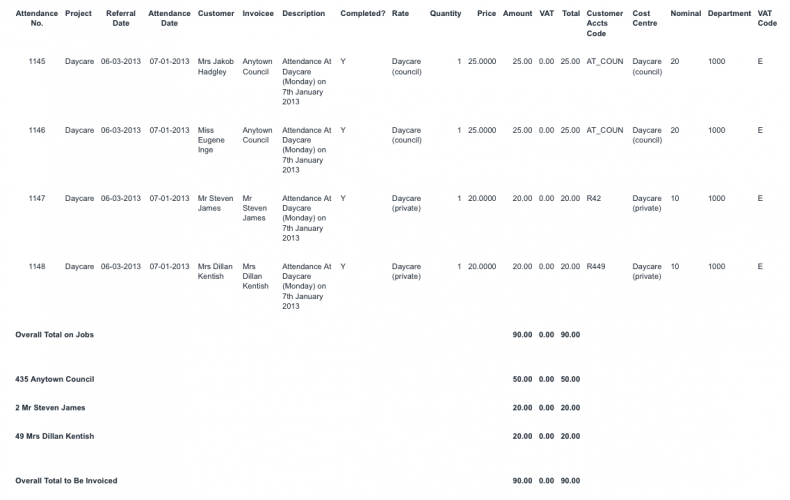

Clicking "Print Report" will show you the relevant invoices, which can then be created if you wish. The result of the report is shown below (the screenshot is a bit cramped, but you get the idea).

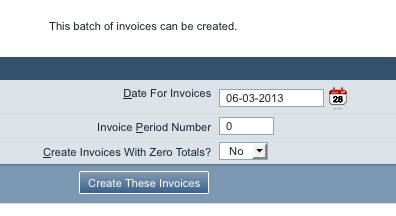

At this point you can check the totals for correctness, and if you wish, click "Create these invoices" with the relevant options. (If there are codes missing, the system will warn you of this fact, and give a message of "these invoices cannot be created".)

Creating the invoices only happens once. Therefore, if you are not certain if the underlying data is correct, do not create them until it is.

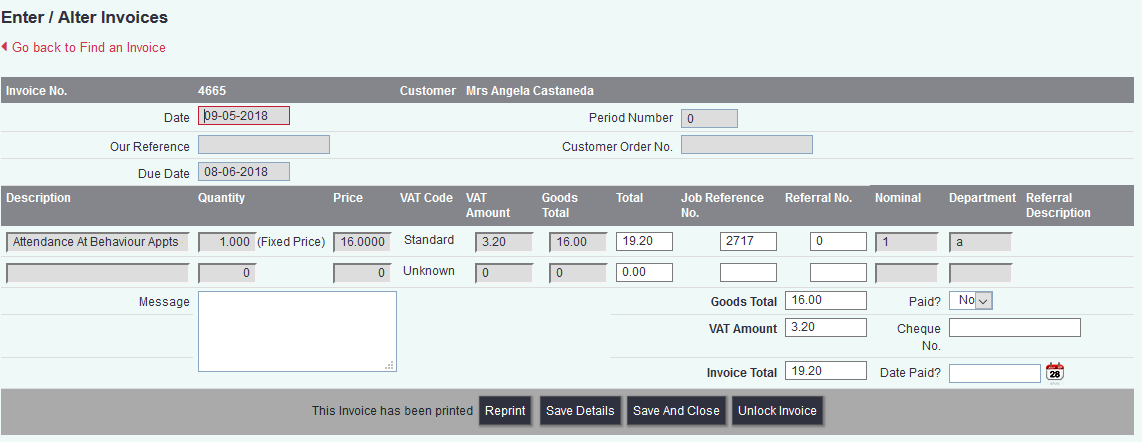

Checking invoice details using "View Invoices" and "List Invoices"

When the invoices are created, the system assigns each a number automatically, and they can be checked prior to printing and/or exporting.

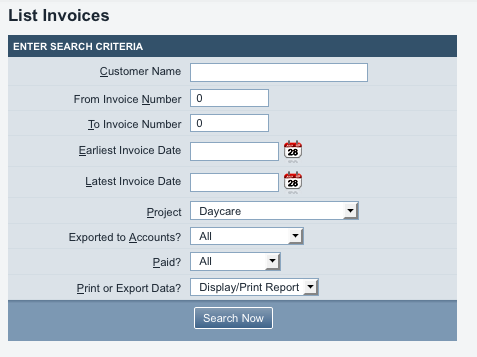

The "List Invoices" menu item allows you to see all the invoices within a date range or an invoice number range (or both), for any Project. You can also narrow your search to unexported invoices, exported invoices, or both; also paid or unpaid invoices only.

The result of this query, for the test scenario, is shown here:

The two clients that attend as private clients have been invoiced their £20 each for daycare. The two clients that are paid for by the council have been combined (since the council will only receive one invoice).

If you want to alter these totals, if something is not correct, this can be done using the "View Invoices" menu item. This uses the same report criteria as the invoice list, but will show you the invoices line-by-line with the opportunity to alter them.

Clicking on an invoice number will take you to that invoice for editing.

You can now alter the invoice amounts if needed, before printing.

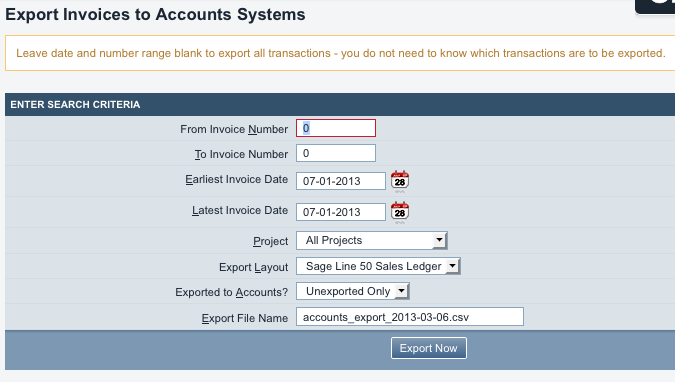

If this invoice has already been paid, you can enter the details of the payment on this screen too;

This information will print on the invoices themselves, and also in some reports.

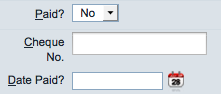

Printing invoices

There are several ways to print invoices. Single invoices can be created by using "View Invoices", clicking on the invoice number and clicking "Print Invoice". This will print one invoice only.

Alternatively you can use the "Print Invoices" menu item, which will let you specify a date range (or an invoice number range), and then print all invoices that match that range in one go.

This is an example of an invoice printout.

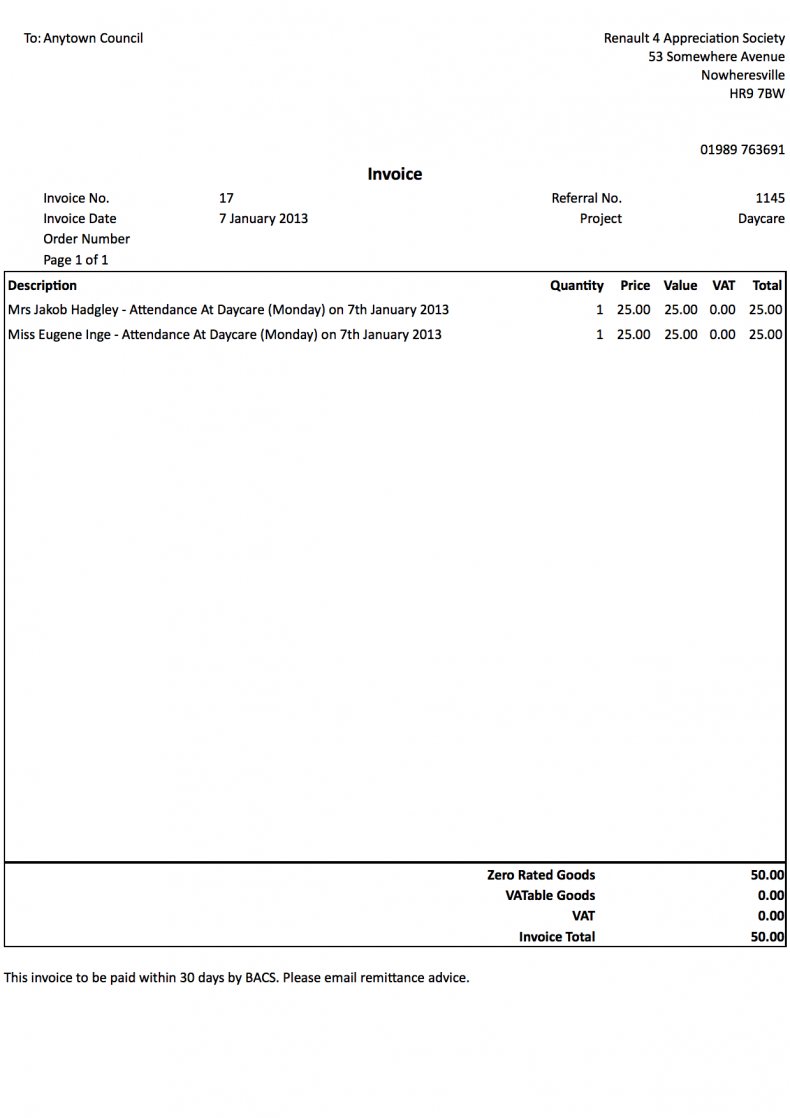

Exporting invoice data to Sage/Access Accounts

You can use the "Export Invoices" menu item to export invoice data to Sage, or to Access Accounts.

- Date range and invoice number ranges can be specified - leave these blank to export everything.

- Information can be exported to Sage Line 50 or Access Accounts - both will create a CSV file but the formatting is different.

- You can narrow the results by project.

- By default the system will only export invoices that haven't been exported already.

IMPORTANT: Once exported, invoices CANNOT be changed, unlike printing where you can print, check for errors, and edit. Once exported, editing using "View Invoices" will no longer be possible. Therefore, don't export your invoices until you are sure that the invoice amounts are correct.

Clicking the "Export Now" button will download a .csv file to your computer, ready for importing to your accounts package.

Accounting for Support Worker activity

Don't forget that before creating invoices for Support Worker activity, you will need to assign accounts codes to anyone who will receive an invoice.

Cost Centres for Support Worker activity

The cost centres for Support Worker activity can be found in the "General Accounts Set Up" submenu, along with the other cost centres (they are all set up in the same place).

It is easiest to think of the cost centres required in terms of the Services your organisation delivers using the Support Worker module. Setting up one cost centre for each service is a good place to start.

It is also helpful to do this setup with an example scenario in mind, so here it is;

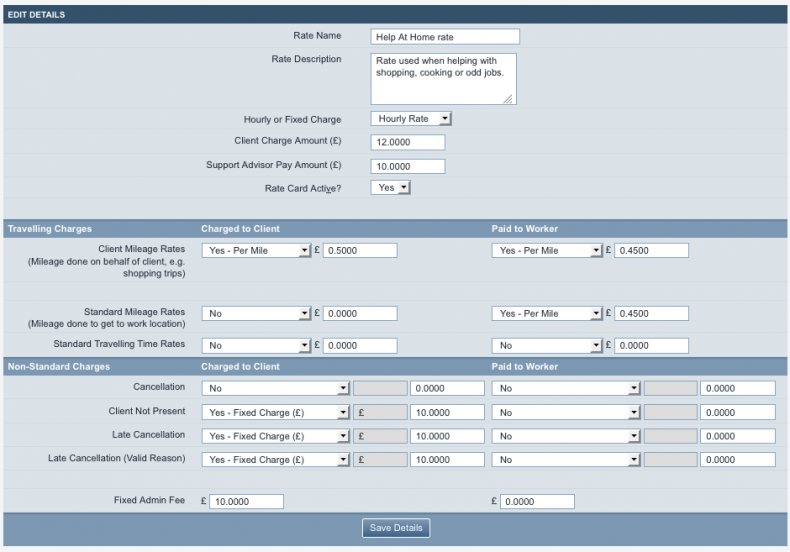

Our organisation delivers a Help At Home service, using paid staff, and managed with Charitylog's Support Worker module. Clients pay £10 per appointment to cover administration. They also pay £12 per hour for the services, and support workers are paid £10 per hour. Clients pay 50p per mile if the support worker drives them anywhere. The support workers are paid 45p per mile for any mileage they do (but they are not paid for time spent travelling). The services delivered are mainly shopping (either on behalf of the client, or accompanying the client), cooking and odd jobs.

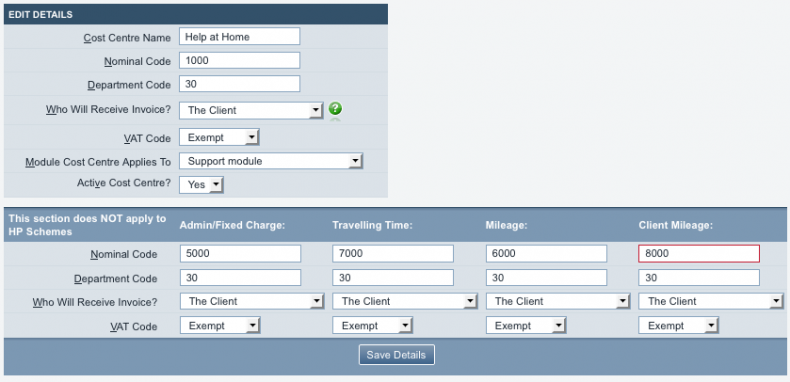

We also need department and nominal codes for this activity. Let's extend the ones we used before with an extra department code for Help At Home;

Department codes

Daycare (private clients): 10 Daycare (council clients): 20 Help At Home: 30

Nominal codes

General/other: 1000 Fixed charges and administration costs: 5000 Travel time: 7000 Mileage: 6000 Client mileage: 8000

This scenario can be managed with one cost centre, set up as shown;

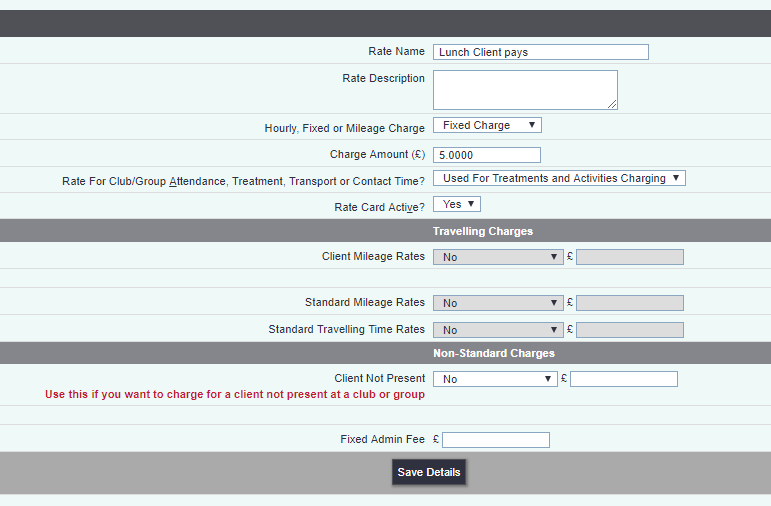

And one charge rate, set up as shown;

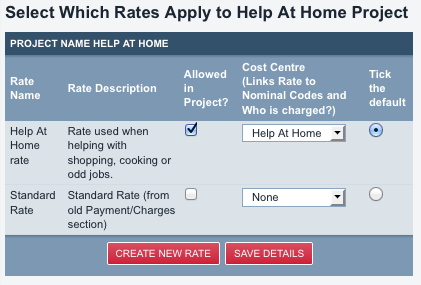

Once these are set up, you can link the cost centre and the charge rates by clicking the "Rates in Projects" menu item in the "Support Accounts Set Up" submenu item.

Assigning rates to activity

Now that the cost centre and charge rates are set up, and allowed in the project, you need to set a charge rate for each activity which will be invoiced. Details of how to do this can be found here: Assigning Charge Rates to Support Worker activity.

Carry out activity

Once the charge rates are assigned, the work can be carried out in Charitylog in the usual way.

See The Administrator Guide to the Support Worker module for details of how to set up the Support Worker module; see the end user guide to the Support Worker module for details of how to run the module.

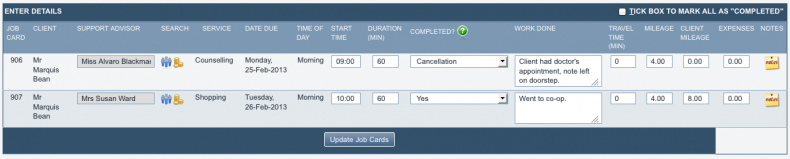

This screenshot shows an example entry screen for some chargeable activity. Note that both activities have a charge rate set (the pile of coins is gold), and that the counselling appointment was cancelled but the shopping trip went ahead as planned.

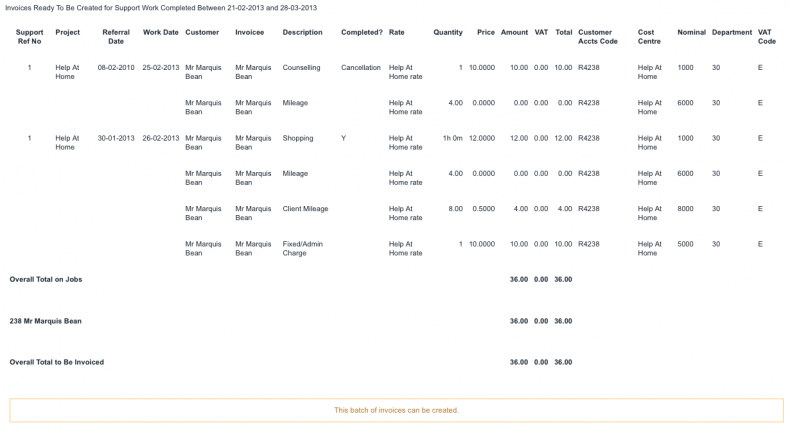

Support Worker pre-invoice lists

Once the support work has been carried out, you should be able to check the pre-invoice list to see that the invoices will create properly. If there are any missing codes related to the activity, you will be informed of this. Click on "SW Pre-invoice List" in the "Invoices" submenu.

You can now specify a date range, project and support team (ignore the "teams" drop-down box if you are not using support teams). The pre-invoice list forms the basis of the invoices actually being created, so unless you know that you need to create invoices from all of the results, it's best to specify which projects you want to check invoices for and when.

The screenshot below shows an output from the pre-invoice list - click on the image to see it full size.

The charges displayed are as follows -

- The client has been charged for the cancellation of the counselling appointment but not for the mileage taken for the support worker to get there.

- At the shopping appointment the client has been charged the £10 administration fee and the £12 for one hour's support work.

- The client has also been charged for 8 miles of client mileage at £0.50/mile, but not charged for the 4 miles that the support worker did in order to get to the appointment.

At this point you can check the totals for correctness, and if you wish, click "Create these invoices" with the relevant options. (If there are codes missing, the system will warn you of this fact, and give a message of "these invoices cannot be created".)

Creating the invoices only happens once. Therefore, if you are not certain if the underlying data is correct, do not create them until it is.

View/List invoices, printing invoices and exporting

From this point the Support Worker accounting works in the same way as for Clubs & Clinics - see this section above - 5.7, 5.8 and 5.9.

Accounting for Handyperson activity

Handyperson accounting differs slightly from accounting for Support Worker or Individual Budget activity, so read carefully.

The first step you will need to take is to give all those who are going to receive invoices an accounts code.

Handyperson cost centres

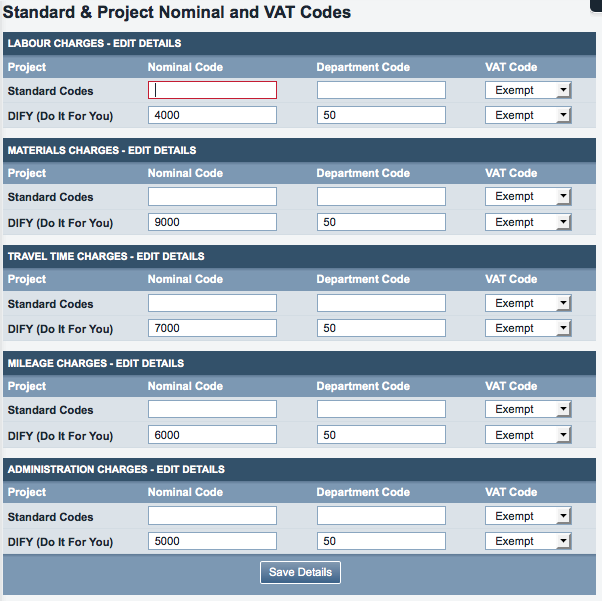

You will need a cost centre set up for Handyperson activity, but this does not bring in department and nominal codes in quite the same way as accounting for other projects.

Assignment of department and nominal codes is done by Project within the Handyperson module. For each Project, you need to assign nominal and department codes to the various different materials, admin fees etc within that project. Click "HP Standard & Project Nominal Codes".

Then set up the nominal and department codes (in the screenshot, they have only been set up for the Do It For You project). Click "Save Details".

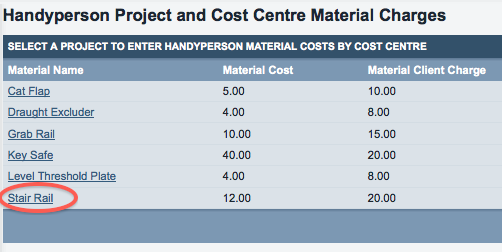

Charges for Handyperson activity

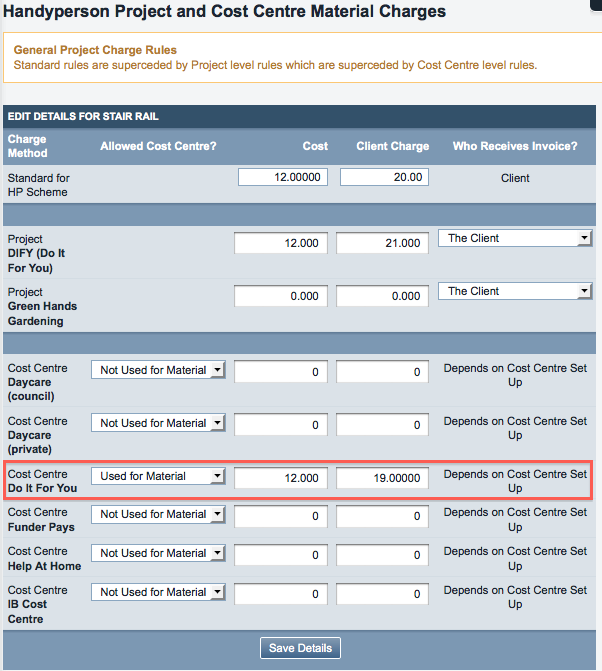

Now you will need to say what will be charged for the materials and time spent, etc. Click on "HP Material Costs".

Then click on the name of a material.

The standard charges will be shown, as set up in "normal" Handyperson module costings. For each material, you will now need to enter the cost to be charged under the relevant cost centre. Don't worry about cost centres that do not relate to Handyperson activity. In the screenshot, the relevant cost centre is the "Do It For You" cost centre.

Project Labour Costs

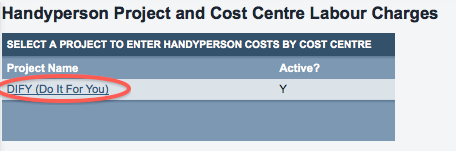

Once all the relevant materials have been set up, click on "HP Project Labour Costs"...

...then click on the name of the Project in question...

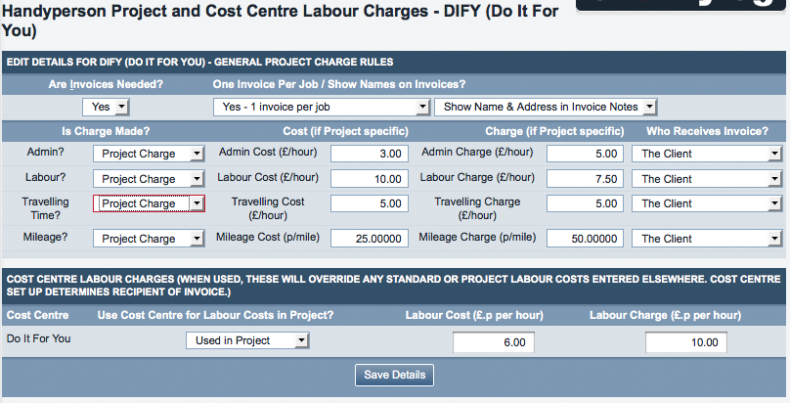

...which will take you to a screen where you can set the remaining options which will allow you to invoice for Handyperson work under this Project.

Note that you can choose to invoice different people for different parts of the work. If a project is part funded by several different sources, it may be appropriate for one funder to pay for the materials and another to pay for the labour and time spent.

Handyperson Pre-Invoice Lists

Once the Handyperson work has been carried out, you should be able to check the pre-invoice list to see that the invoices will create properly. If there are any missing codes related to the activity, you will be informed of this. Click on "HP Pre-invoice List" in the "Invoices" submenu.

You can now choose various options for how the invoices will display, similar to the other Pre-Invoice Lists.

When you have selected your options, click "Print Report". Your output should look something like this:

At the bottom of the screen, you will be told whether there are codes missing, or whether this batch of invoices can be created.

At this point, if the invoices do not look right, you still have the opportunity to go back and change them. Doing this for Handyperson work is tricky, but possible. You will need to mark the referral as incomplete before the system will allow you to change anything on the job card(s) relating to the referral. Once the changes have been made, you will need to mark the referral as complete again. Note that doing this will cause labour costs to be updated to current rates, so be careful if trying to edit older referrals. Ideally, create invoices fairly quickly after the work is done to prevent this being an issue.

View/List invoices, printing invoices and exporting

From this point the Handyperson accounting works in the same way as for Clubs & Clinics - see this section above - 5.7, 5.8 and 5.9.

This concludes the Accounts section.

Click to go back to the Administrator Manual.

Click to go to the next section, Outcomes.