Invoicing for the Roster Module

Don't forget that before creating invoices for Support Worker activity, you will need to assign accounts codes to anyone who will receive an invoice.

Contents

Cost Centres for Support Worker activity

The cost centres for Support Worker activity can be found in the "General Accounts Set Up" submenu, along with the other cost centres (they are all set up in the same place).

It is easiest to think of the cost centres required in terms of the Services your organisation delivers using the Support Worker module. Setting up one cost centre for each service is a good place to start.

It is also helpful to do this setup with an example scenario in mind, so here it is;

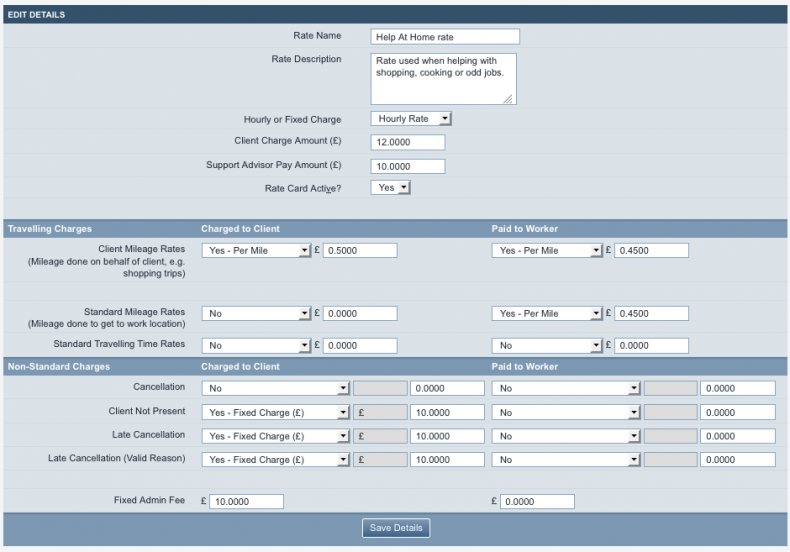

Our organisation delivers a Help At Home service, using paid staff, and managed with Charitylog's Support Worker module. Clients pay £10 per appointment to cover administration. They also pay £12 per hour for the services, and support workers are paid £10 per hour. Clients pay 50p per mile if the support worker drives them anywhere. The support workers are paid 45p per mile for any mileage they do (but they are not paid for time spent travelling). The services delivered are mainly shopping (either on behalf of the client, or accompanying the client), cooking and odd jobs.

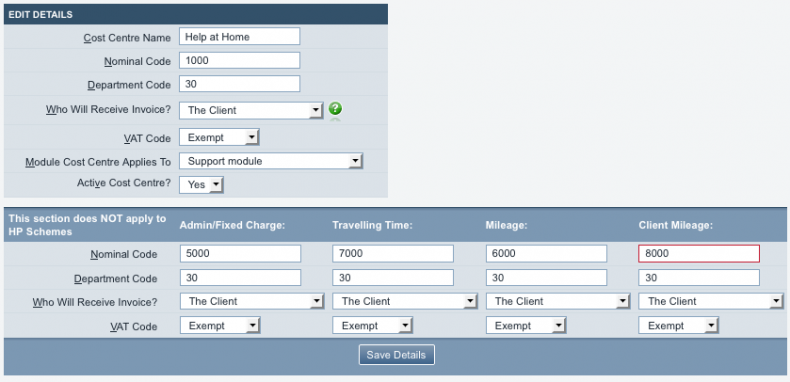

We also need department and nominal codes for this activity. Let's extend the ones we used before with an extra department code for Help At Home;

Department codes

Daycare (private clients): 10 Daycare (council clients): 20 Help At Home: 30

Nominal codes

General/other: 1000 Fixed charges and administration costs: 5000 Travel time: 7000 Mileage: 6000 Client mileage: 8000

This scenario can be managed with one cost centre, set up as shown;

And one charge rate, set up as shown;

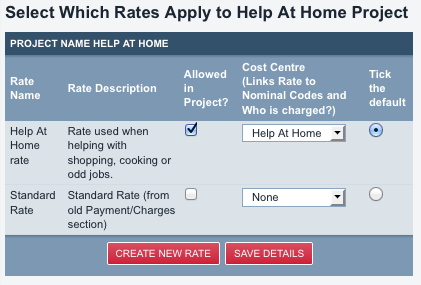

Once these are set up, you can link the cost centre and the charge rates by clicking the "Rates in Projects" menu item in the "Support Accounts Set Up" submenu item.

Assigning rates to activity

Now that the cost centre and charge rates are set up, and allowed in the project, you need to set a charge rate for each activity which will be invoiced. Details of how to do this can be found here: Assigning Charge Rates to Support Worker activity.

Carry out activity

Once the charge rates are assigned, the work can be carried out in Charitylog in the usual way.

See The Administrator Guide to the Support Worker module for details of how to set up the Support Worker module; see the end user guide to the Support Worker module for details of how to run the module.

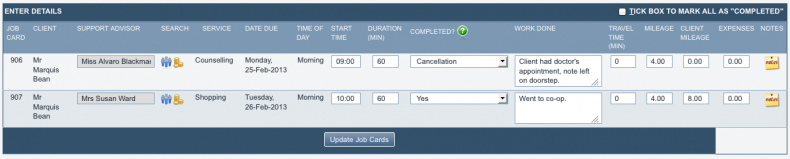

This screenshot shows an example entry screen for some chargeable activity. Note that both activities have a charge rate set (the pile of coins is gold), and that the counselling appointment was cancelled but the shopping trip went ahead as planned.

Support Worker pre-invoice lists

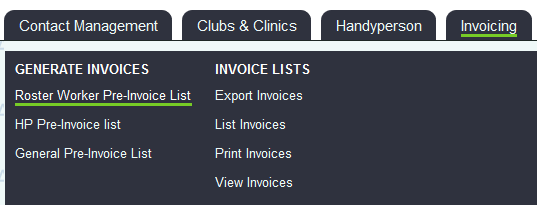

Once the support work has been carried out, you should be able to check the pre-invoice list to see that the invoices will create properly. If there are any missing codes related to the activity, you will be informed of this. Click on "SW Pre-invoice List" in the "Invoices" submenu.

You can now specify a date range, project and support team (ignore the "teams" drop-down box if you are not using support teams). The pre-invoice list forms the basis of the invoices actually being created, so unless you know that you need to create invoices from all of the results, it's best to specify which projects you want to check invoices for and when.

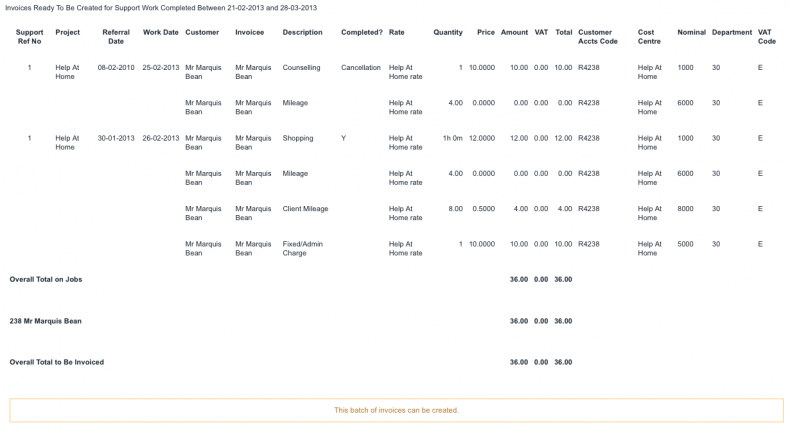

The screenshot below shows an output from the pre-invoice list - click on the image to see it full size.

The charges displayed are as follows -

- The client has been charged for the cancellation of the counselling appointment but not for the mileage taken for the support worker to get there.

- At the shopping appointment the client has been charged the £10 administration fee and the £12 for one hour's support work.

- The client has also been charged for 8 miles of client mileage at £0.50/mile, but not charged for the 4 miles that the support worker did in order to get to the appointment.

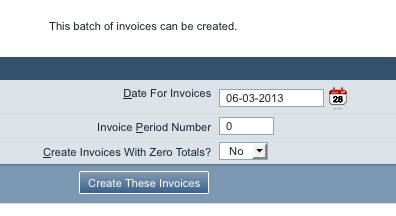

At this point you can check the totals for correctness, and if you wish, click "Create these invoices" with the relevant options. (If there are codes missing, the system will warn you of this fact, and give a message of "these invoices cannot be created".)

Creating the invoices only happens once. Therefore, if you are not certain if the underlying data is correct, do not create them until it is.

View/List invoices, printing invoices and exporting

From this point the Support Worker accounting works in the same way as for Clubs & Clinics - see this section above - 5.7, 5.8 and 5.9.