Travel Rule Sets

From Charitylog Manual

NOTE: This needs the google enhanced mapping feature in order to calculate mileage and time. Please contact the support team to turn this on.

Travel rule sets are used to calculate how much mileage your workers should be paid for their daily shift.

This can be set up to take into account whether they are going home in between jobs and whether they should be paid going to and from home. It can also be used to set maximum payable mileage or time.

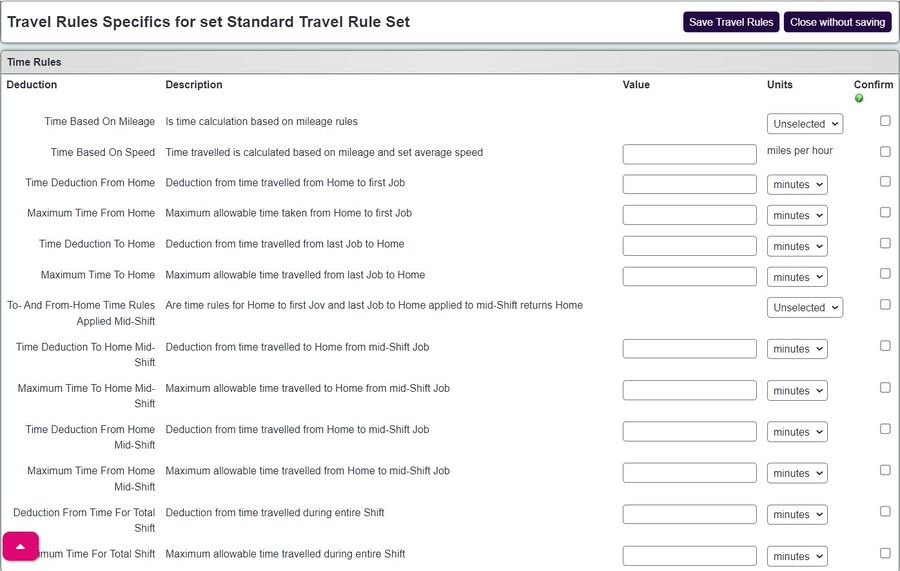

The rules for mileage and time are very similar - you can choose to calculate time paid based on their mileage, or have a different set of rules.

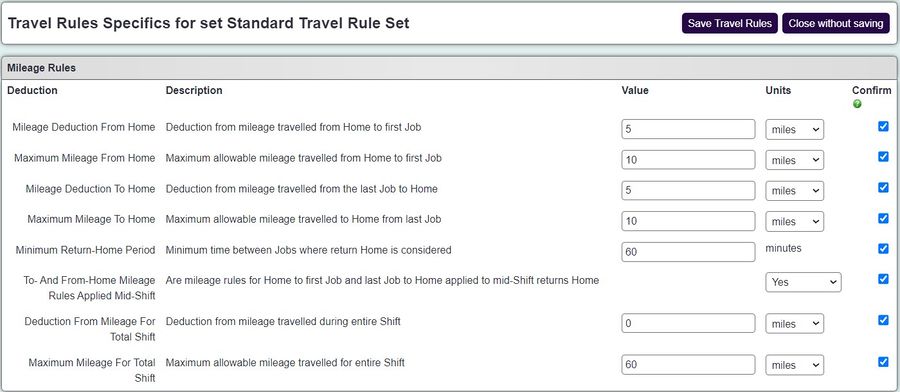

The options available are:

- Deduction to/from home: If you want to take off a percentage or unit of time/mileage, such as paying 50% of their to/from home mileage, enter it here.

- Maximum to/from home: Allows you to set a maximum payable time/mileage to or from home.

- Minimum return-home period: Allows you to set the time between jobs where the worker will return home. For example, if the threshold is 30 minutes and there is only 20 minutes between jobs, it will be assumed that the worker went straight from one job to the next.

- To and from home rules applied to mid-shift: When set to yes, the rules above will be applied to the mid-shift returns home. If set to no, the following questions will be available-

- Deduction to/from home mid-shift: Set a deduction for mid-shift returns home if you wish it to be different to the regular to/from home payment.

- Maximum to/from home mid-shift: Set a maximum for mid-shift returns home if you wish it to be different to the regular to/from home payment.

- Deduction for total shift: If you want to deduct an amount from the overall mileage/time enter it here.

- Maximum time/mileage for total shift: Allows you to set a maximum payable mileage/time for the entire shift.